Crypto market making is a crucial aspect of the cryptocurrency industry. It involves trading on a crypto centralised exchange (CEX) or decentralised exchange (DEX) to provide liquidity to the market. In this article, we’ll explain what crypto market making is and why it’s essential. We’ll also discuss the benefits of market making as well as some different types of market making strategies.

What is Crypto Market Making and Why is it Important in the Crypto World?

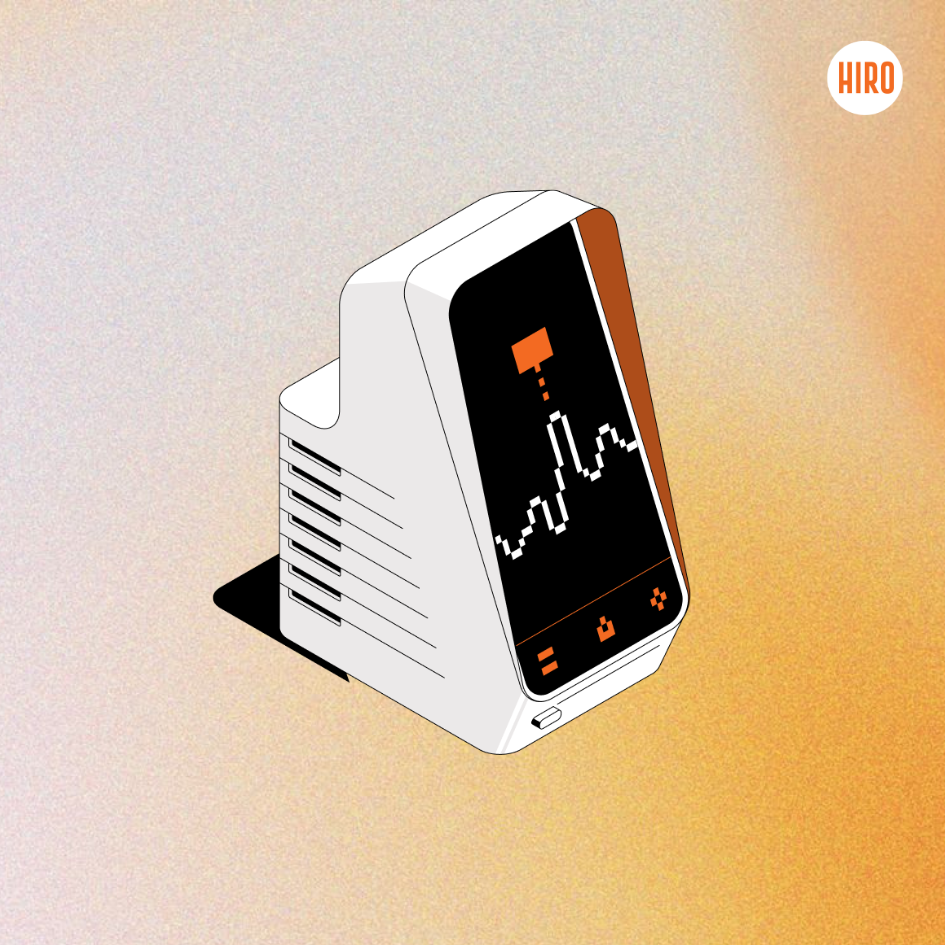

Crypto market making is the process of continuously buying and selling cryptocurrencies on a crypto exchange to ensure that there’s always liquidity in the market. A crypto market maker is an individual or a company that provides liquidity to the market by placing buy and sell orders on an exchange, populating the orderbook to maintain a tight spread and sufficient depth of liquidity. The market maker’s role is to ensure that there’s always a buyer or seller for any given cryptocurrency, thus allowing organic trading activity and preventing large price fluctuations.

The importance of market making in the crypto world cannot be overstated. In a market without market makers, large price spreads and fluctuations can occur due to the low liquidity in the market. A fragile market can be easily manipulated which can lead to market participants losing money, which can harm the overall health of the market. Market makers, therefore, play a vital role in providing stability to the market, which is necessary for the growth and success of the industry.

The Benefits of Market Making

Crypto market making comes with several benefits, which include:

- Increased Liquidity

The primary benefit of market making is that it increases liquidity in the market. By providing liquidity, market makers ensure that there’s always a buyer or seller for any given cryptocurrency, which reduces the likelihood of large price fluctuations and enables trading. - Reduced Volatility

Market making also helps to reduce volatility in the market. When there’s low liquidity in the market, even a small trade can have a significant impact on the price. Market makers help to prevent this by providing liquidity, which reduces the impact of any given trade on the price of a cryptocurrency. - Market Stability

Market making helps to provide market stability. By ensuring that there’s always liquidity in the market, market makers prevent large price fluctuations, which can lead to market instability. This, in turn, helps to create a more stable and healthy crypto industry. - Profitability

Lastly, market making can be a profitable business for those who do it well. By buying and selling cryptocurrencies at different prices, market makers can make a profit on the spread between the bid and ask prices. Market makers who use statistical arbitrage or delta neutral market making strategies can also make a profit by exploiting market inefficiencies.

Market Making Strategies

There are several types of market making strategies that crypto market makers use to provide liquidity. These strategies include:

- Continuous Quote Market Making (CQMM)

This is the most commonly used market making strategy in the crypto industry. In CQMM, the market maker continuously quotes bid and ask prices for a given cryptocurrency on an exchange. The market maker’s goal is to maintain a narrow spread between the bid and ask prices, which ensures that there’s always liquidity in the market. - Statistical Arbitrage Market Making

In this strategy, the market maker uses statistical analysis to identify market inefficiencies that can be exploited for profit. The market maker takes advantage of these inefficiencies by buying and selling cryptocurrencies at different prices to make a profit. This strategy requires advanced algorithms and a sufficiently liquid market to be effective. - Delta Neutral Market Making

In delta neutral market making, the market maker uses options contracts to hedge against price movements in the underlying cryptocurrency. This strategy involves buying and selling options contracts to ensure that the market maker’s position is delta neutral, meaning that the market maker’s position is not affected by changes in the price of the underlying cryptocurrency.

Suggested links